Are We on the Brink of a New Great Depression?

While the current global economy is not yet in a depression, several warning signs echo the conditions of the early 1930s. These include systemic financial vulnerabilities, growing geopolitical instability, and deepening socioeconomic divisions.

Key Indicators Raising Concern

Surging Consumer & Government Debt

Household and federal debt are at record highs. The U.S. faces mounting interest obligations, while consumers are increasingly reliant on credit to cover essentials.Fragile Global Growth

China’s real estate market is imploding. Europe is sliding toward recession. Capital flight and dollar strength are crushing emerging markets.Banking Sector Weakness

The 2023 failures of Silicon Valley Bank and Credit Suisse revealed fragility in bank balance sheets. Rising rates are eroding asset values—a 1930s echo.

“The shock absorbers of the post-2008 system are starting to fray. A sudden credit freeze today could be even more contagious than in the 1930s,”

says Professor Leon Briggs, economic historian at Defined Benefits.

Persistent Inflation + High Interest Rates

The Fed’s tightening cycle has cooled inflation—but at the cost of increasing debt burdens and throttling small business growth.Labor Market Softening

Underemployment and multiple job-holding are rising beneath the surface of a strong headline jobs number. Layoffs in logistics, tech, and retail are increasing.Geopolitical Disruptions

Conflicts in Ukraine and the Middle East, combined with a retreat from global trade norms, mirror the protectionist spiral that worsened the Depression.Wealth Inequality and Political Dysfunction

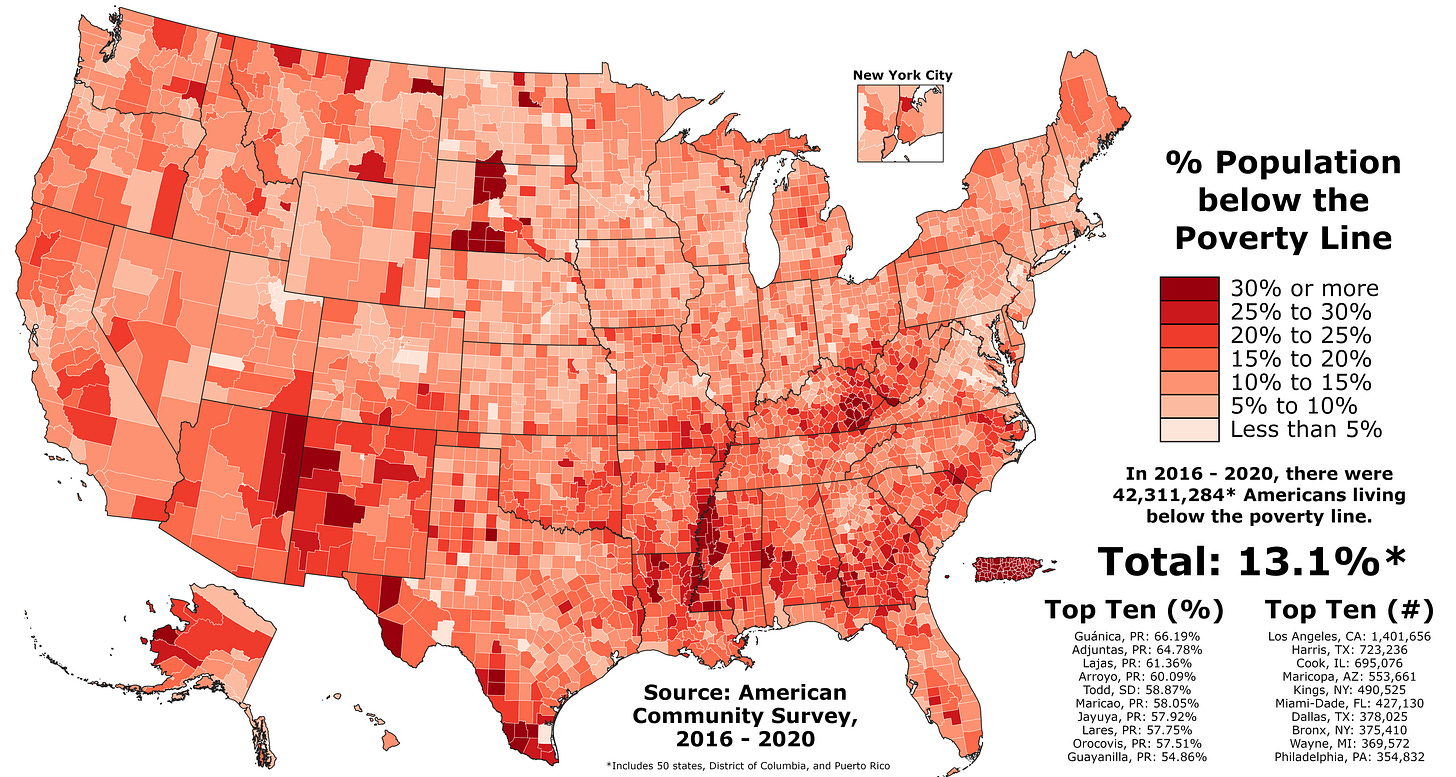

The U.S. is as unequal today as it was in 1929, and polarization in Washington has hampered proactive economic policy.

“When economic pain grows faster than institutional trust, the result isn’t just recession—it’s a legitimacy crisis,”

notes Dr. Helena Markov, senior fellow at Defined Benefits.

Commercial Real Estate Risk

Office buildings remain largely vacant. Small banks—heavily exposed to these loans—face rising default risk, potentially sparking a regional banking contagion.

Why This Isn’t 1930 (Yet)

There are key differences today:

The FDIC insures deposits.

The Fed can provide emergency liquidity.

Automatic stabilizers (like unemployment insurance and Social Security) cushion shocks.

There is no rigid gold standard limiting monetary response.

Still, if policy errors or shocks converge, a deflationary spiral or liquidity collapse remains possible.

While we’re not in a Great Depression, the underlying stressors are real and building. The lessons of 1930–1933 show that slow responses and political paralysis can turn recession into catastrophe.

If you're tracking this closely and want a curated list of indicators or resilience strategies, I can put that together.